Lamina Brokers for Dummies

Some cash advance lenders need you to repay your funding at the very same location where you obtained your loan. In a lot of provinces, a payday lender can not expand or roll over your payday funding.

Each province has guidelines concerning what must be in the agreement. It generally consists of: quantity obtained charges repayment routine finance due date Read your arrangement thoroughly before authorizing it. Ask the payday lender regarding anything you do not understand. You may have severe consequences if you don't make your payments in a timely manner.

This consists of when and also exactly how typically the loan provider might contact you. It additionally includes what tactics the lender may make use of to obtain you to pay. If you do not make your cash advance lending settlements on schedule, you might obtain stuck in a debt trap. You might have problem making ends satisfy since you can't pay your debts.

Not known Details About Lamina Brokers

That's not the case with online payday car loans. The time taken to process a cash advance lending differs from one company to one more as well as is an element that you must consider when picking a cash advance finance lending institution - it can be immediate, within hrs or a day.

Aligning your funding with your monthly repayment makes sure that you will not struggle to repay the funding financial obligation. A lot of standard finances come with limitations on how you can use your borrowed money.

A poor credit rating refutes you a possibility to obtain a standard finance almost everywhere. That is not the instance with payday advance loan. Payday advance have minimum demands that leave out credit history sign in most firms. Whenever a company asks for credit score checks, they use you an option to negotiate for an extra significant quantity.

Cash advance fundings are controlled by different laws in Canada as well as appoint constitutionally established rates of interest limitations. Once you have actually been removed to obtain a loan, the cash will automatically be debited to your account. On the cash advance, the lending institution will instantly subtract a comparable quantity plus rate of interest from your account.

Facts About Lamina Brokers Uncovered

Nevertheless, these companies are licensed by regulation not to share your details with 3rd party companies. Aggressive cash advance companies are a thing of the past as proper regulations has actually been placed in location to facilitate safe as well as secure purchases as well as business procedures. Nevertheless, it is sensible to pick look here credible lenders with a tested record in providing reputable services to consumers as well as reasonable rate of interest rates.

If you are managing a bank it can take a week or longer to hear back to learn whether you have actually been authorized or otherwise. Too, when you require smaller amounts of cash, the financial institutions simply aren't willing to function with you. There are just a few basic requirements that you should fulfill in order to get a cash advance.

There is no collateral called for and you do not require to gain a high quantity of cash to qualify. If you have actually located yourself having a hard time in the past and are dealing with poor debt, you can still get authorized for a cash advance. You just need to demonstrate that you can pay it back on time.

On-line payday advance, usually called "poor credit history fundings," "cash loan lendings," as well as other similar names, are temporary fundings that should be settled completely when you obtain your next income - Lamina Brokers. Obtaining an on the internet payday advance loan won't usually need a credit history check, however you may have to pay even more in passion.

More About Lamina Brokers

$5,000 loans 5-min application No added application costs Over 2,000,000 consumers Swift approval Limited in some US states Money Mutual is an all-round platform with a flawless reputation that helped it accumulate over 2,000,000 completely satisfied customers. You can lend anywhere between $100 as well as $5,000, but what excited us the most was how swiftly you are connected to potential lending institutions.

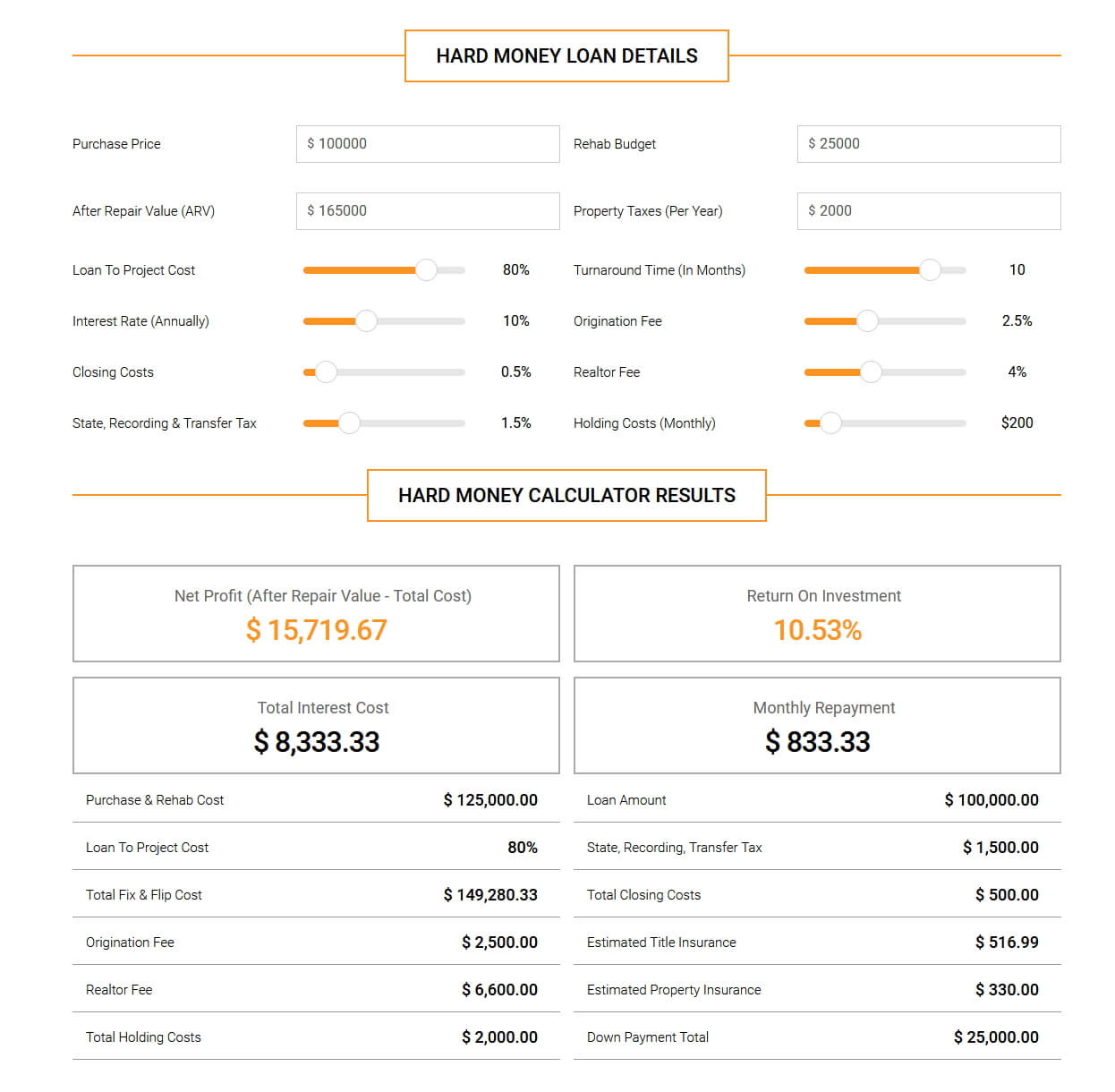

Collateral is not required, as well as the range of available lending institutions is quite thorough. If you meet the criteria as well as stick within the limit, the financing will reach your account within a company day. When paying back, you can select between 3 as well as 72 months to pay off the financing. Rate pop over to this web-site of interest: 5.

However, they do use a greater lending cap than various other lenders at $35,000. Rate Of Interest: Varies depending upon the lender Minimum Optimum Funding Quantity: Up to $35,000 Finance Term: Varies depending upon the lender $1,000 car loans Simple registration Fundings accepted in mins Easy to navigate Entrepreneurs are welcome Might use extra instructional resources If you require a funding quick, you won't find it quicker to purchase now and also pay later lendings than what 24/7 Dollar Loan supplies.

Approvals can take as low as a minute. 24/7 Buck additionally welcomes entrepreneurs with the specific requirements as normal customers. It would certainly aid if you were a click here for info United States person with financial savings or a checking account, gaining $800 or more month-to-month. While the platform must supply more public academic resources, this internet site is reasonable and lawful as well as has no effect on any one of the loan providers' rate of interest choices and terms.